Market Snapshot for May 2024 shows that Closed Sales are down year over year, but Active Inventory and New Listings are up 102.3% and 46.6% respectively.

New listings increased 5.5% in April 2024, with an 18.4% increase in Active Inventory compared to April 2024. Days on Market increased year over year by 5.9%, and month over month by 12.5%.

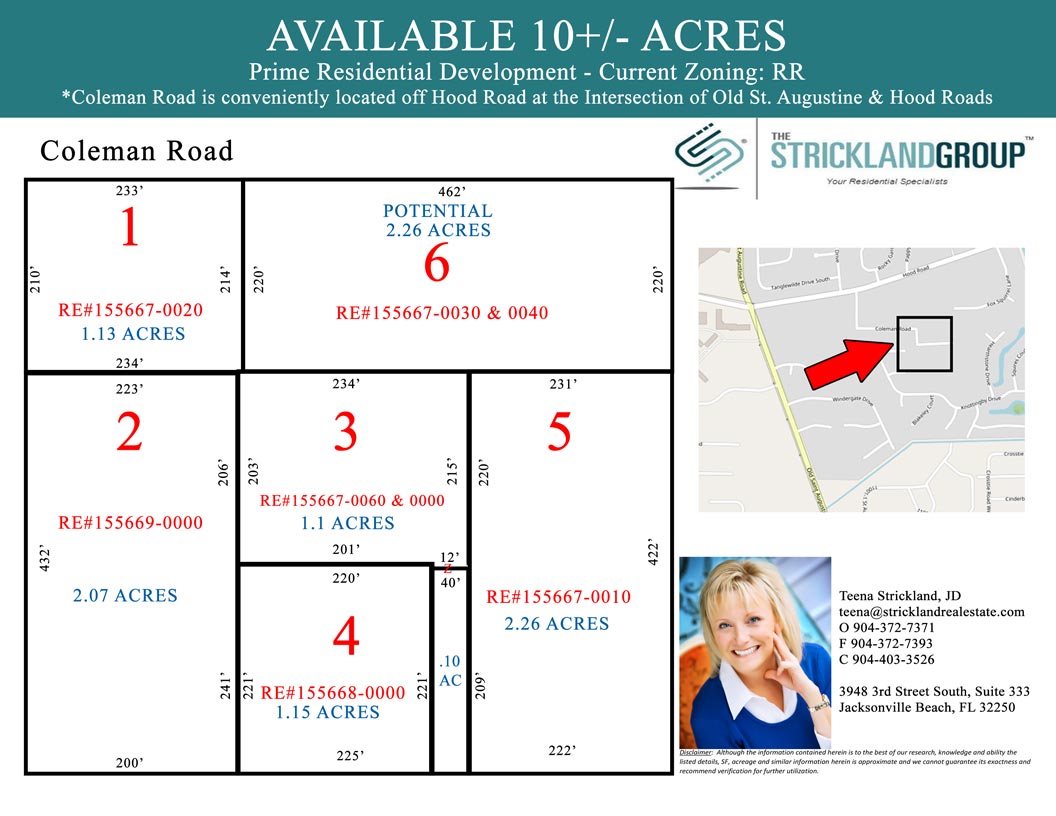

Reach out today for more info!