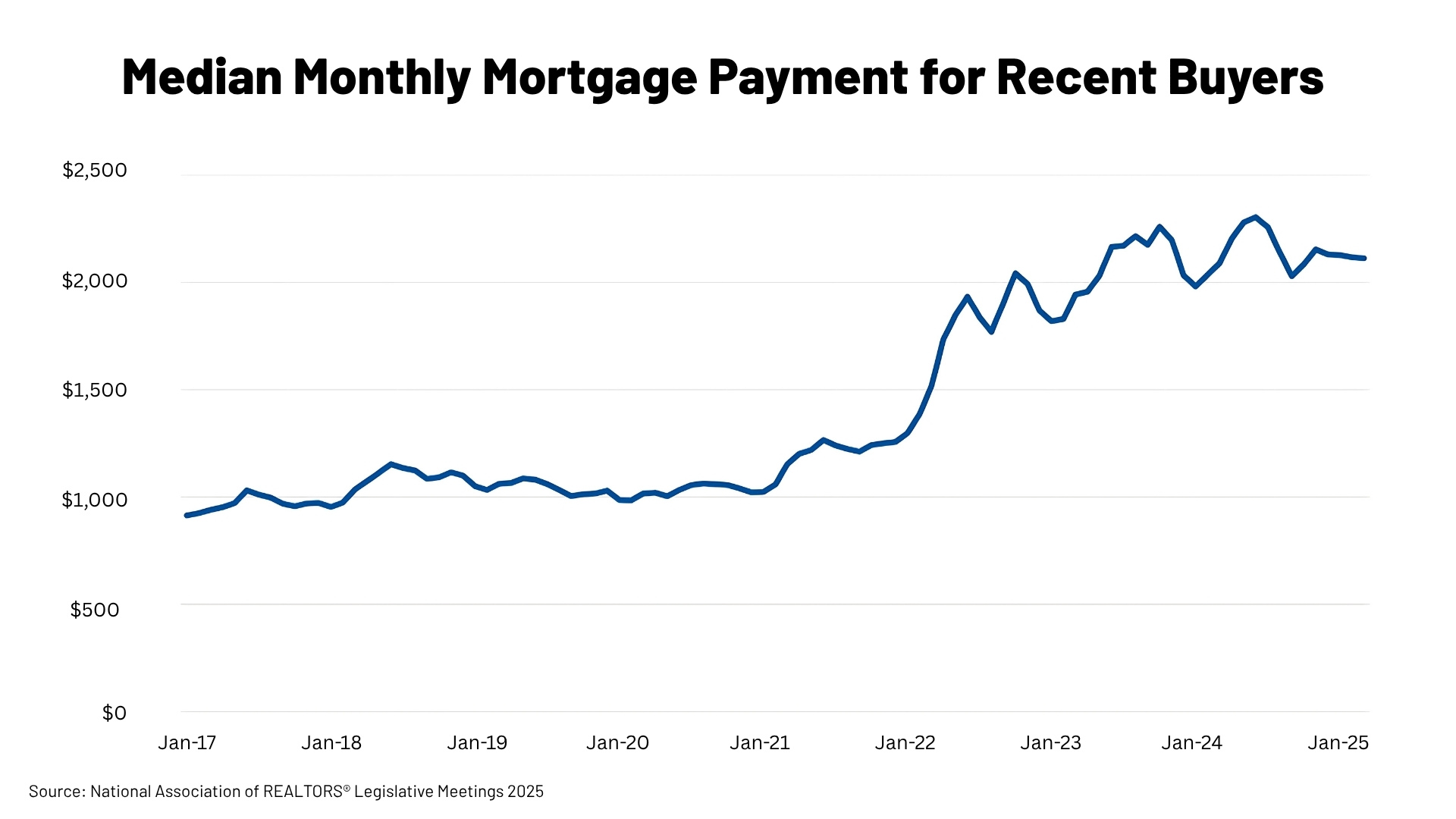

When most homebuyers calculate whether they can afford a new home, they focus almost exclusively on one number: the monthly mortgage payment. It’s the figure lenders qualify them for, the number discussed during showings, and the benchmark used to determine budgets.

The average annual cost of owning and maintaining a single-family home in the U.S., excluding the mortgage itself, is estimated at around $21,400 in 2025—roughly $1,800 per month.1 When you factor in these national average ownership expenses, a $2,500 monthly mortgage can grow to over $4,000 in total housing costs.

Qualifying for a mortgage answers one question: “Can a bank trust you with this loan?” It doesn’t answer the more important one: “Can you comfortably maintain this lifestyle?”

In today’s market, where nearly 45% of homeowners report post-purchase regrets (most commonly because maintenance and hidden costs were higher than expected), understanding the full financial picture before buying has never been more important.2

The Predictable Ongoing Costs

Property Taxes

Property tax bills have been rising sharply nationwide, with the average reaching $4,271 in 2024 and many homeowners seeing increases of 16% or more.3 Even where tax rates dip slightly, rising home values keep actual bills climbing—creating the irony that a home’s appreciation increases annual expenses.

Property taxes aren’t truly fixed. Reassessments happen regularly, and as neighborhood values rise, so do tax bills—even when rates stay the same.

Homeowners Insurance

As of December 2025, the average premium for a new policy rose 8.5% year-over-year.4 Climate disasters, higher rebuilding costs, and insurer risk recalibration continue driving these increases, and the trend shows no signs of reversing.

A homeowner could see their monthly payment jump $200-300 in a single year without taking any action themselves—simply because their mortgage servicer adjusted the escrow to cover higher insurance premiums.

HOA Dues

About 40% of homes for sale have HOA fees, with median costs around $125 per month, though single-family homes typically range from $200-$300 monthly.5 These fees rarely decrease and often include special assessments that can add thousands in unexpected annual costs.

Utilities

In 2024, energy and utility costs averaged $4,494 annually, with internet and cable adding another $1,515.1 Buyers moving from apartments to single-family homes often see these costs double due to increased square footage, outdoor irrigation, and climate control demands.

Routine Maintenance

Beyond emergencies, homes require ongoing care: lawn service, gutter cleaning, pest control, HVAC servicing, and seasonal tasks. These aren’t luxuries for many households—they’re practical solutions to time constraints and property upkeep. Collectively, these services can add $200-400 monthly to ownership costs.

The Irregular—but Inevitable—Expenses

Major System Replacements

This is where many homeowners get caught off guard. Maintenance and repairs aren’t a matter of “if” but “when”—and recent years have made “when” far more expensive.

Home maintenance now averages around $8,800 annually, with first-year homeowners often facing even higher costs.1,6Major repairs aren’t cheap:

- HVAC replacement: $5,000-$10,000

- Roof replacement: $8,000-$15,000

- Water heater: $1,200-$2,500

- Foundation repairs: $4,000-$12,000

These aren’t possibilities—they’re certainties with varying timelines.

Use the inspection as a planning tool. A 15-year-old water heater or aging roof signals $8,000-12,000 in likely expenses within the first few years. That’s not a deal-breaker—it’s a budget roadmap. Buyers who understand these timelines can plan strategically instead of scrambling when systems fail.

Newer isn’t maintenance-free. Newer builds offer a temporary reprieve, but systems still age, warranties expire, and eventually every home requires major capital improvements.

Emergency repairs happen at the worst times. An HVAC failure during a heat wave, a burst pipe in winter, or storm damage to the roof—these scenarios happen when it’s least convenient and most expensive. Without liquid reserves, a single emergency can derail finances entirely.

Ownership Costs That Creep Up Over Time

Here’s what surprises many first-time buyers: the so-called “fixed costs” of homeownership aren’t actually fixed.

While a locked-rate mortgage provides payment stability, the escrowed components—taxes and insurance—can climb significantly year over year due to inflation, climate risk, and local policy changes. A mortgage payment that felt comfortable at closing can feel tight three years later, even without lifestyle changes.

Picture this: a letter arrives saying the monthly payment is increasing $200 because insurance premiums rose and the property was reassessed at a higher value. No move, no refinance, no renovation—yet annual housing costs just jumped $2,400.

The same gradual creep affects utilities, maintenance services, and every other aspect of homeownership. Budgeting for homeownership means expecting these costs to rise 3-5% annually. True stability requires planning for volatility.

Planning Smarter: How Homeowners Can Stay Ahead

The encouraging news: buyer’s remorse is largely preventable. The issue isn’t buying the wrong house—it’s buying without adequate preparation.

Create a Dedicated House Repair Fund

Separate from emergency savings, this fund exists solely for home maintenance and repairs. Treat it like a non-negotiable monthly bill—set up automatic transfers so it happens without thinking about it.

The old rule of saving 1% of your home’s value annually? It’s outdated. Plan for more—closer to 2-3% of your home’s value annually, or whatever amount lets you sleep at night knowing the HVAC won’t derail your budget.

Don’t Drain Your Savings at Closing

Cash reserves protect against surprises and prevent forced debt when repairs arise. If possible, keep several thousand dollars liquid after closing rather than putting every available dollar into the down payment or upgrades. That breathing room matters more than most buyers realize.

Invest in Preventative Maintenance

Annual HVAC servicing, gutter cleaning, and seasonal inspections catch small problems before they become expensive emergencies. A modest service call that prevents a major system failure is always worthwhile.

Create a seasonal maintenance calendar: HVAC checkups in spring and fall, gutter cleaning before winter, roof inspections after major storms. Consistency prevents costly surprises.

Know Your Home’s Systems and Timelines

Understanding when major systems were last replaced helps predict future expenses. A 12-year-old water heater isn’t an emergency today, but it signals a likely expense within 2-3 years. Planning beats scrambling.

When Homeownership Still Make Sense

Despite the expenses, homeownership remains one of the most powerful wealth-building tools available to American families—when approached correctly!

Long-Term Equity Building

Mortgage payments build equity with every payment. Unlike rent, ownership creates a forced savings mechanism that compounds over decades. In most markets, homes appreciate over time, multiplying the wealth-building effect.

Stability and Control

Homeowners control their living environment. Want to renovate the kitchen, paint the walls, landscape the yard, or install solar panels? Ownership provides autonomy that renting never will. That control has both lifestyle and financial value.

Predictability vs. Rent Volatility

While ownership costs rise gradually over time, rent increases can be sudden and dramatic—with national rents climbing 31% over the past five year.7 A fixed-rate mortgage provides payment predictability that renting cannot match.

Yes, taxes and insurance increase, but the principal and interest portion—typically 60-70% of the total payment—remains locked. Renters face volatility on 100% of their housing costs.

Lifestyle Benefits

Beyond finances, homeownership offers intangible benefits: deeper community roots, stability for families, space for hobbies, and the pride of building something that’s truly yours. These benefits have real value, even if they don’t appear on a balance sheet.

The key is ensuring the financial foundation supports the lifestyle, not undermines it.

A Better Way to Think About Affordability

The true measure of affordability isn’t what a lender will approve—it’s what allows sleeping well at night when the water heater fails or the insurance premium spikes.

The smartest buyers calculate affordability as “mortgage plus carrying costs” from the start, which might narrow the price range slightly but creates breathing room and peace of mind.

Homeownership remains one of the most powerful wealth-building tools available, but only when approached with financial realism rather than maximum leverage. Having an honest conversation about what affordability truly looks like isn’t about limiting dreams—it’s about making sure those dreams don’t become financial nightmares.

Sources:

- Bankrate:

https://www.bankrate.com/home-equity/hidden-costs-of-homeownership-study/ - Bankrate:

https://www.bankrate.com/f/102997/x/c84a6b9359/homeowner-regrets-survey-press-release.pdf - Matic:

https://matic.com/blog/2026-home-insurance-predictions/ - NAHB:

https://www.nahb.org/blog/2025/12/property-taxes-2024-residential/ - Realtor.com:

https://www.realtor.com/research/homeowners-associations-2024/ - Inman:

https://www.inman.com/2026/01/12/as-home-maintenance-costs-rise-agents-turn-to-tools-that-reduce-buyer-risk/ - Rentec Direct:

https://www.rentecdirect.com/blog/new-data-shows-the-state-of-rent-in-2025-from-rentec-direct/